The UK property market is one of the most dynamic in the world, constantly shifting with economic trends, policy changes, and buyer demand. Whether you’re buying your first home, hunting for a rental flat, managing a commercial unit, or investing in equestrian property for sale, having a comprehensive property checklist is absolutely vital. It acts as your roadmap, helping you navigate through the complexity with confidence, clarity, and peace of mind.

A property checklist doesn’t just help avoid costly mistakes — it empowers you to ask the right questions, spot potential issues early, and evaluate properties objectively. From legal paperwork and property valuation to utilities and location, this guide will walk you through everything you need to check off before signing any agreement. It’s your essential toolkit for understanding every stage of the process, whether you’re dealing with a charming cottage in Edinburgh or a commercial property in central London.

Pre-Viewing Property Checklist: Laying the Groundwork

Before you even book a viewing, it’s critical to prepare properly. This stage is often rushed, but it can make all the difference between securing your ideal property and wasting time on unsuitable options. A solid property checklist at this point begins with defining your needs: What type of property are you looking for? Is it residential, commercial, or a hybrid space? Are you browsing property for sale near me listings or exploring opportunities like property for sale in Spain?

Buyers should focus on securing mortgage pre-approval, understanding deposit requirements, and identifying key search criteria like school catchments, transport links, and local amenities. Renters, meanwhile, should consider affordability, contract lengths, and whether utilities are included. Use platforms like Property Pal, Property Pool Plus, or Find a Property to build your shortlist based on accurate filters and real-time property news. Every step matters at this early stage, so don’t skip the research.

Property Viewing Checklist: Inspect What You Expect

Once you’re on-site, the viewing process is more than a casual look — it’s a full inspection. Bring your property checklist along and take notes. Begin with the exterior: check for cracks in walls, roof damage, poor drainage, and any signs of neglect. Don’t ignore the area around the property either — noise levels, street condition, and neighbouring buildings can have a huge impact on value and quality of life.

Inside the property, examine walls, ceilings, plumbing, heating systems, and electrical fixtures. Look for damp, poor insulation, or inadequate natural light. Confirm the layout meets your needs, whether that’s space for a home office or enough outlets for modern appliances. For commercial property, evaluate foot traffic, business viability, and available parking. A thorough checklist ensures you never miss critical details — even during a fast-paced open house or guided tour.

Legal and Document Verification Checklist

Property ownership and transactions in the UK are governed by strict legal processes. This is where your property checklist becomes a legal defence tool. Before agreeing to any purchase or tenancy, verify all documents: title deed, EPC certificate, planning permission, building regulations approval, and property boundary maps. Confirm whether the property is leasehold or freehold, and review service charges or ground rent details if applicable.

Engaging professionals such as Premier Property Lawyers is a smart move, particularly for complex transactions or properties involving inheritance, joint ownership, or overseas ownership. Landlords must provide tenants with an Assured Shorthold Tenancy agreement, deposit protection details, and safety certificates. Renters should never accept verbal agreements without signed contracts. Legal oversights are some of the most expensive mistakes in the UK property market — your checklist helps keep you protected.

Financial and Tax Responsibilities to Include

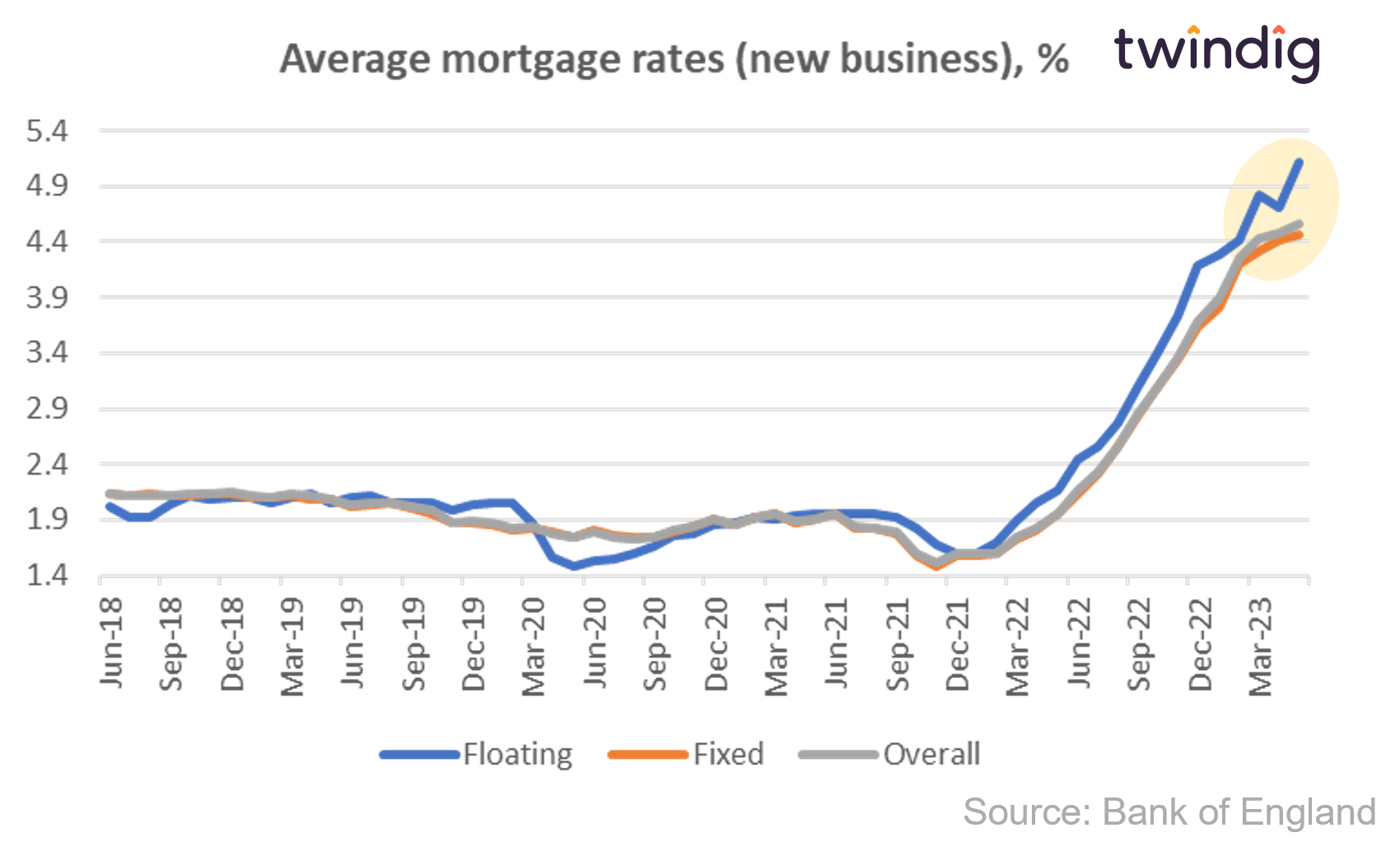

Money matters in property, and your property checklist should fully cover all financial obligations. For buyers, this includes stamp duty, solicitor fees, property surveys, and moving costs. Don’t forget ongoing expenses like council tax, home insurance, and utilities. Property valuation plays a key role — always compare the listed price with similar homes in the area using trusted online tools or surveyors.

If you’re buying a commercial property for sale, consider business rates, VAT implications, and fit-out costs. Landlords should budget for maintenance, void periods, and tax on rental income. Renters, too, should plan for upfront costs like deposits and first-month rent, along with monthly bills. Having a financial breakdown in your property checklist ensures nothing catches you off guard. It also gives you the power to negotiate better terms and stay within budget.

Special Considerations for Unique Properties

Not all properties are created equal. If you’re exploring equestrian property for sale, you’ll need to include land drainage, access rights, stabling facilities, and rural planning permissions on your checklist. For commercial properties, zoning laws, accessibility, and tenant agreements are key points to verify. Investing in real estate is a long-term commitment — your property checklist should be tailored to match the type of property and purpose.

Keeping up with property news NI, regional development plans, and government policies can also help you make smarter decisions. Areas undergoing regeneration may offer better returns, while properties near new infrastructure can rise in value quickly. Whether you’re looking to diversify with commercial property for rent or buy-to-let opportunities, your checklist should include a market overview to back your decision.

Final Checks Before Signing or Moving In

Once you’re ready to close the deal, it’s time for one last review. A final walk-through using your property checklist helps ensure everything is as promised. For buyers, this means checking agreed repairs, confirming fixtures and fittings, and preparing for conveyancing. Renters should double-check the inventory list and ensure any pre-existing damage is documented with photos.

Set up your utilities, internet, and insurance ahead of time to avoid delays. Landlords should carry out a move-in inspection with the tenant present, record meter readings, and ensure safety alarms are working. These final steps are often rushed, but they can prevent disputes later. Think of it as your last line of defence before you fully take ownership or occupancy.

Conclusion

A comprehensive property checklist is more than a tool — it’s a necessity for navigating today’s property market. Whether you’re buying a cosy flat in the city, renting a suburban home, or leasing commercial property, your checklist ensures no stone is left unturned. It helps you approach the process with confidence, making informed decisions that protect your money and your future.

From planning and viewings to legal checks and final inspections, your checklist empowers you every step of the way. With so many variables in the UK property landscape, from intellectual property concerns in commercial leases to rural-specific checks for equestrian property, there’s no room for guesswork. Start with a checklist — and move with certainty.

FAQs

What is a property checklist and why is it important?

A property checklist is a structured list used to evaluate a property before renting, buying, or selling. It helps identify issues, compare properties fairly, and make informed decisions.

Can I use the same checklist for commercial and residential property?

Not entirely. While some parts overlap, commercial properties require additional checks such as business rates, zoning, and tenancy flexibility.

How do I check the legal status of a property?

Review documents like the title deed, planning permissions, and EPC certificates. It’s best to consult a solicitor or legal expert to avoid costly mistakes.

Are there free tools to help me build a property checklist?

Yes, platforms like Property Pal, Property Pool, and Zoopla often provide templates or checklists you can customise.

Does this checklist apply if I’m buying property abroad, like in Spain?

While the structure remains helpful, foreign property laws differ. Always consult a local property expert when buying abroad.

You may also read: Is It a Buyers or Sellers Market in the UK? The 2025 Housing Outlook