Understanding the current mortgage interest rates UK is crucial for anyone looking to buy a property, remortgage, or invest in real estate in 2025. With the Bank of England base rate held at 4.25%, mortgage providers across the UK have adjusted their products to reflect this, meaning now is the time to shop around.

Whether you’re a first-time buyer, homeowner looking to remortgage, or considering a buy-to-let investment, keeping informed about current mortgage interest rates UK can help you save thousands over the life of your loan.

What are mortgage interest rates and how do they affect you?

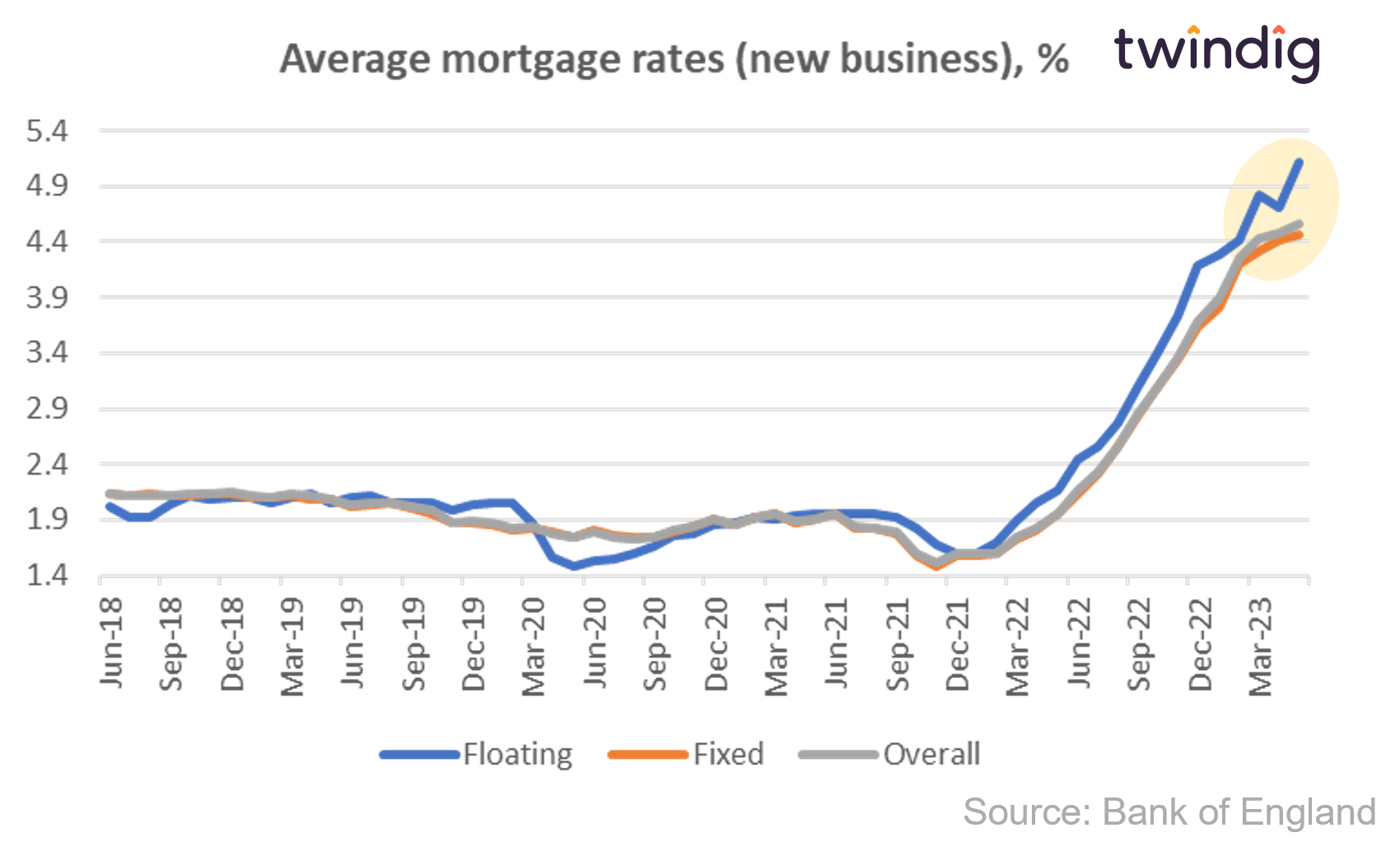

Mortgage interest rates represent the cost of borrowing money from a lender to purchase a property. The rate you receive depends on a variety of factors including your credit score, deposit size, loan term, and the lender’s pricing structure. Fixed and tracker deals remain the most common types in the UK market.

Changes in the Bank of England base rate play a key role in determining the current mortgage interest rates UK. Fixed rates provide stability by locking in your rate, while variable or tracker rates may rise or fall depending on economic conditions. This makes it vital to track rates monthly if you’re looking for the best deal.

Snapshot of current mortgage interest rates UK (June 2025)

Here’s an overview of the current mortgage interest rates UK based on leading sources such as Rightmove, HSBC, and Uswitch:

- 2-Year Fixed Rate Mortgages: 4.43% – 4.61% for 75–85% LTV

- 5-Year Fixed Rate Mortgages: 4.49% – 4.57%

- Tracker Rates: ~6.74% (e.g. TSB follow-on tracker)

- Standard Variable Rates (SVR): 6.75% – 7.74%

Major lenders like Nationwide, HSBC, and NatWest are offering attractive fixed and tracker mortgage deals. For instance, HSBC currently features a 2-year fixed mortgage as low as 4.03%, depending on your deposit and eligibility.

Fixed vs tracker mortgage deals – which should you choose?

Choosing between fixed and tracker rates depends on your financial goals. Fixed-rate mortgages offer predictable monthly payments, which can be comforting in times of economic uncertainty. Many UK borrowers in 2025 are opting to lock in rates due to inflation concerns and potential base rate increases.

Tracker mortgages, however, are tied to the Bank of England base rate, meaning your rate could go down if the base rate drops. While some homebuyers might find trackers appealing, the unpredictability means they’re not suitable for everyone. You’ll need to weigh the risk carefully, especially with how volatile the current mortgage interest rates UK are.

Use a mortgage calculator before you apply

Before committing to any mortgage product, it’s essential to use a mortgage calculator UK. These online tools allow you to estimate your monthly repayments based on the loan amount, rate, and term. This helps you budget and understand what you can realistically afford.

A mortgage repayment calculator breaks down how much you’ll pay in interest versus principal over time. If you’re planning to make extra payments, a mortgage overpayment calculator can show how much you’ll save in interest and how quickly you can become mortgage-free.

Compare lenders: Who has the best mortgage rates right now?

In today’s climate, the current mortgage interest rates UK can differ widely between lenders. Here’s a glance at what some of the top providers are offering this month:

- HSBC Mortgage Rates: 2-year fixed from 4.03%, 5-year fixed from 4.18%

- Nationwide Mortgage Rates: Strong deals across all LTV bands, especially for members

- NatWest Mortgage: A wide range of tracker and fixed-rate options via NatWest mortgage login

- Barclays and Santander: Competitive for buy-to-let and remortgage customers

Always review fees, cashback offers, free valuation perks, and early repayment charges before locking in a deal. Tools like mortgage comparison platforms can help you identify hidden costs or find exclusive offers.

Buy-to-let mortgage market outlook in 2025

If you’re considering becoming a landlord, knowing the current mortgage interest rates UK is vital for profitability. Buy-to-let mortgages typically come with higher rates and stricter lending criteria. As of June 2025, average buy-to-let rates sit between 5.25% and 6.25%.

Demand for rental property remains strong, particularly in urban centres like Manchester, Edinburgh, and Birmingham. Still, higher mortgage costs are squeezing rental margins, so comparing rates and using a mortgage calculator UK for income stress testing is crucial before making any commitment.

Scottish Mortgage share price is not a mortgage rate

A common confusion online involves the Scottish Mortgage share price, which many mistake as related to actual home loans. However, Scottish Mortgage is an investment trust and has nothing to do with your home loan interest rates. Keep your focus on actual mortgage products from UK lenders and not stock listings.

When researching the current mortgage interest rates UK, make sure you’re reviewing reputable financial or mortgage comparison sites to avoid misinformation.

Tips for getting the best mortgage deal in 2025

To get the best deal on the market, you must first improve your mortgage profile. Lenders reward borrowers with good credit scores, larger deposits, and steady incomes with lower interest rates. It also helps to compare a wide range of lenders and not just your existing bank.

Other smart strategies include:

- Locking in a deal early if rates are predicted to rise

- Avoiding high arrangement fees unless offset by low interest

- Using a mortgage comparison website to track daily changes

- Consulting with a broker for tailored advice

Being proactive is key when navigating the current mortgage interest rates UK. With small differences in rates potentially costing thousands, even a 0.1% difference can matter.

Conclusion – why staying informed gives you the edge

The current mortgage interest rates UK remain a key factor in your home-buying or remortgaging decision. Whether rates go up or down, your financial readiness and ability to compare deals make all the difference.

By using calculators, checking lender offers, and staying updated on rate trends, you’ll not only make better choices—you’ll save money in the long run. Don’t settle for the first rate you find. Search, compare, and secure the mortgage that works for you in 2025.

Frequently Asked Questions

What is the current average mortgage interest rate in the UK?

As of June 2025, average 2-year fixed rates range from 4.43% to 4.61%, while 5-year fixed rates average 4.49% to 4.57%.

Should I choose a fixed or tracker mortgage in 2025?

If you want predictability, go for a fixed rate. If you expect interest rates to drop, a tracker mortgage may save you money—but it’s riskier.

How can I compare current mortgage interest rates UK?

Use a mortgage comparison tool or speak to a broker to compare deals across lenders quickly and efficiently.

Are buy-to-let mortgage rates higher?

Yes, typically 1% or more higher than residential rates. As of June 2025, average buy-to-let rates are around 5.25%–6.25%.

Can I overpay my mortgage to save money?

Yes. Use a mortgage overpayment calculator to see how much interest you could save and how quickly you can shorten your mortgage term.

You may also read: Websites for Estate Agents: Best UK Platforms for Lead Generation & Property Listings (2025)