Mortgage rates in the UK are a key concern for both aspiring homeowners and seasoned property investors. As of June 12, 2025, the latest figures indicate a mild dip in average rates compared to the previous month. With inflation stabilising and the Bank of England holding interest rates steady, many lenders are beginning to offer slightly more favourable deals to borrowers. This provides a glimmer of hope in what has been a tight and expensive housing market over the past two years.

Those looking to buy, remortgage or invest in buy to let properties are encouraged to act quickly, as today’s mortgage rates may not last long. With lenders like NatWest, Nationwide, and HSBC adjusting their offers daily, keeping an eye on the market is crucial. Online tools like a mortgage calculator or mortgage repayment calculator make this process more manageable, helping buyers calculate costs and compare the most competitive deals.

Current Mortgage Rates in the UK – What’s New?

The average fixed-rate mortgage now sits between 6.75% and 6.89%, depending on loan-to-value ratios and mortgage term lengths. Two-year fixed rates are slightly cheaper than 5-year options, though the difference is narrowing. Nationwide mortgage rates remain competitive, and HSBC mortgage rates are drawing interest for shorter-term products. These movements reflect a cautious optimism in the financial sector that rates could continue to fall modestly through the second half of 2025.

However, variable and tracker rate mortgages remain unpredictable. While they currently offer lower initial rates, they are tied to the Bank of England base rate, meaning any future hikes could significantly increase repayments. Buyers using a UK mortgage calculator are strongly advised to compare scenarios and assess whether the long-term security of a fixed-rate deal outweighs the potential short-term savings of variable options.

Why Mortgage Rates Fluctuate – Key Factors Explained

Mortgage rates don’t move randomly—they are shaped by multiple economic indicators. One of the most significant drivers is the Bank of England base rate, which has been held steady to combat inflation. As inflationary pressure eases, the cost of borrowing could gradually come down, potentially lowering mortgage interest rates for millions of UK borrowers.

Other important influences include the bond market, lender risk assessments, and competition among banks. Current mortgage rates are also shaped by global economic forces, such as energy prices and geopolitical instability. In uncertain times, lenders increase rates to minimise risk, but in more stable conditions, they compete more aggressively, driving rates down. This is why tools like a mortgage comparison site or a mortgage calculator UK tool are vital for identifying the best mortgage rates available at any given time.

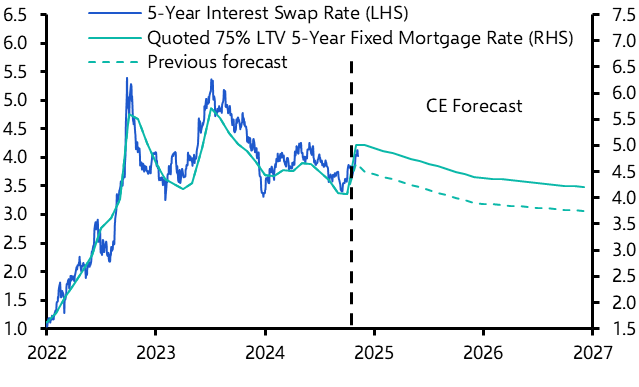

UK Mortgage Rate Forecast for the Rest of 2025

Market analysts are cautiously predicting that mortgage rates in the UK may drop slightly toward the end of 2025, especially if inflation continues to cool and economic growth picks up. While no dramatic reductions are expected, we may see rates fall closer to the 6.5% mark by December. This is encouraging for both homebuyers and investors, especially those planning long-term purchases or remortgaging.

The Scottish Mortgage share price has shown stability in recent months, indicating broader confidence in the property and investment markets. However, borrowers are reminded that timing is everything. Rates can change quickly, and locking in today’s rate—if it suits your financial goals—could offer savings down the line. Be sure to use a mortgage overpayment calculator to explore the benefits of repaying your loan faster under the current rate climate.

Comparing Mortgage Deals – Tools to Make Smarter Choices

Comparing mortgage deals has never been easier. Dozens of UK-based websites now offer real-time mortgage comparison tools, helping users evaluate products from high street lenders and specialist banks. These platforms allow users to enter property value, deposit size, and income to instantly view which mortgage rates they qualify for.

Additionally, mortgage calculators and mortgage repayment calculators help visualise the total cost of the loan, including interest over time. Many comparison sites now integrate tools to show the impact of overpayments or changing interest rates. Whether you’re evaluating Nationwide mortgage rates or checking NatWest mortgage login for a better deal, always cross-reference offers and use data-driven tools to make confident decisions.

Online Tools: Manage Your Mortgage with Ease

With most lenders offering digital banking options, managing a mortgage online has become the new norm. Through services such as the NatWest mortgage login, borrowers can access their current interest rates, review statements, and make payments directly. Many platforms also allow you to apply for overpayments and track how they reduce your term and total interest.

Having access to a mortgage calculator on your banking dashboard is a huge plus. It enables users to simulate how changing interest rates will affect their monthly payments and remaining balance. This real-time financial oversight helps homeowners remain in control, especially when dealing with fluctuating UK mortgage rates in a competitive housing market.

Choosing the Right Mortgage Product

Choosing between fixed, tracker, and offset mortgage options can be daunting. A fixed-rate mortgage locks your monthly repayments for a set period—ideal for budgeting. A tracker mortgage follows the base rate and can result in lower repayments when the base rate drops, though it also carries the risk of increases.

Offset mortgages, meanwhile, let you use savings to reduce the interest charged on your mortgage. Each has pros and cons, and the best choice depends on your financial goals, stability of income, and risk appetite. Use a mortgage calculator to model repayment scenarios, and always compare rates before committing.

Conclusion

Mortgage rates in the UK on June 12, 2025, are beginning to show signs of easing, offering cautious hope for buyers and homeowners alike. While the cost of borrowing remains high by historical standards, improvements in economic indicators and lender competition may push rates lower over the coming months.

Now is the time to use every tool at your disposal—mortgage calculators, overpayment calculators, and comparison websites—to make the most of the current mortgage environment. Whether you’re buying a home, remortgaging, or investing in property, staying informed will give you the edge in navigating the ever-changing world of mortgage rates.

FAQs

What are mortgage rates today in the UK?

Today’s average mortgage rates range from 6.75% to 6.89%, depending on the lender and mortgage term.

Are mortgage rates expected to go down in 2025?

Yes, slight decreases are expected if inflation continues to fall and the economy stabilises.

Which lender has the best mortgage rates?

Lenders such as Nationwide, NatWest, and HSBC are offering some of the best mortgage rates currently available.

How can a mortgage calculator help me?

A mortgage calculator helps you estimate monthly repayments, total loan costs, and explore overpayment savings.

Is now a good time to remortgage?

If your fixed term is ending or your rate is above the current average, now may be a good time to remortgage and secure a better deal.

You may also read: Commercial Property for Sale Edinburgh – Your Complete Guide to Buying in Scotland’s Capital