The Londonmetric share price continues to attract the attention of investors across the UK property and REIT sectors. As one of the major players listed on the London Stock Exchange, LondonMetric Property PLC (LMP) has become a vital stock to watch for those interested in real estate-backed portfolios, particularly those focused on logistics and retail warehousing.

With a market capitalisation of over £4 billion, LondonMetric has undergone significant transformation in recent years. Investors closely monitor the Londonmetric share price for updates on dividends, portfolio shifts, and strategic mergers that may influence long-term growth. This article explores all aspects of the share price, performance, and outlook for LondonMetric in 2025.

What is LondonMetric Property PLC?

LondonMetric Property PLC is a UK-based real estate investment trust (REIT) with a primary focus on logistics, distribution, and long-income retail properties. Formerly known for its involvement in retail parks, the company has strategically realigned its portfolio to focus on distribution-led assets, offering investors more resilient income during changing market cycles.

The company operates under the REIT structure, which offers tax benefits and mandates the distribution of most earnings to shareholders. LondonMetric Property PLC is well-known for its clear strategy, efficient asset management, and a strong track record of delivering shareholder returns. The Londonmetric share price reflects this reputation, supported by a consistent dividend yield and proactive financial management.

Latest Londonmetric Share Price Performance

The latest Londonmetric share price trades around 195.98 GBX, showing stability within a volatile market. Its 52-week range spans from a low of 167.10 GBX to a high of 210.40 GBX, highlighting modest fluctuations and a strong rebound from earlier market corrections. The current price performance positions LMP as a stable REIT option in the UK property sector.

Several financial platforms, including the London Stock Exchange and Hargreaves Lansdown, provide real-time data and charts for the Londonmetric share price. Investors use this information to gauge short-term price movements and long-term trends. The stock remains a staple in many portfolios thanks to its yield potential and robust asset base.

Factors Influencing the Share Price

:max_bytes(150000):strip_icc()/what-are-key-factors-cause-market-go-and-down_round2-ad8487b424d04f71b444ecc9192bc9fa.png)

The Londonmetric share price is influenced by several factors, including macroeconomic conditions, interest rates, and tenant stability. As a logistics-focused REIT, its exposure to e-commerce and retail supply chains plays a crucial role in investor sentiment. Any disruption in these sectors can impact rental income and, by extension, the share price.

Recent developments, such as the merger with LXi REIT, have further shaped the price. This strategic move aims to expand LondonMetric’s footprint across long-income and mission-critical assets. Additionally, offers like the Londonmetric Highcroft REIT offer showcase the company’s expansion strategy and help explain short-term movements in the Londonmetric property share price.

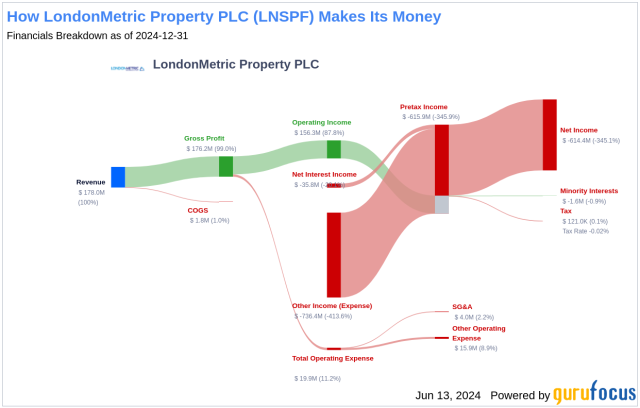

LondonMetric as a REIT: Dividends, Financials, and Investor Insights

As a REIT, LondonMetric Property PLC provides regular dividends, attracting income-focused investors. The company currently offers a dividend yield of over 6%, making it competitive in the UK REIT space. This yield contributes to the strong interest in the Londonmetric share price and supports valuation stability during economic downturns.

Insights from Londonmetric investor relations and the annual report reveal a focused approach to property acquisition and asset recycling. Investors regularly consult these reports to assess the sustainability of the company’s strategy and the outlook for future income. The Londonmetric logo and branding have become synonymous with reliable REIT investment in the UK market.

LondonMetric Share Forecast and Investment Outlook

Market analysts project a stable outlook for the Londonmetric share price over the next 12 months. Following the LXi merger, the company is expected to benefit from increased scale and diversification. Forecasts indicate potential for capital appreciation, though much depends on inflation control and economic resilience in the UK.

Investment outlook for LondonMetric remains optimistic due to its strong fundamentals and disciplined growth. With consistent earnings, portfolio enhancements, and steady demand for logistics space, many see the current Londonmetric share price as an opportunity for long-term gains. Investors are encouraged to track news and updates via official Londonmetric share news releases and financial briefings.

Conclusion

The Londonmetric share price stands as a reliable indicator of performance within the UK REIT landscape. With its strategic emphasis on logistics, strong dividend track record, and recent mergers, LondonMetric continues to be a leading choice for both institutional and retail investors. Those monitoring the LMP stock should remain updated with official financial statements and market movements.

While no investment is without risk, the Londonmetric share price offers a compelling combination of yield, stability, and growth potential. As the UK property sector evolves, LMP’s proactive management and diversified assets position it favourably for long-term success.

Frequently Asked Questions (FAQs)

What is the current Londonmetric share price?

As of the latest update, the Londonmetric share price trades near 195.98 GBX, subject to daily market changes.

Is LondonMetric Property PLC a reliable REIT investment?

Yes, with a strong dividend yield, strategic focus, and consistent financials, LondonMetric is considered a dependable REIT for long-term investors.

Where can I find the latest Londonmetric investor relations updates?

Visit the official LondonMetric Property PLC website under the investor relations section for annual reports, updates, and earnings releases.

How often does LondonMetric pay dividends?

LondonMetric typically pays quarterly dividends, contributing to its appeal among income-focused investors.

What was the impact of the LXi merger on the Londonmetric share price?

The merger expanded the company’s asset base and added long-income assets, which positively influenced investor sentiment and long-term forecasts.

You may also read: Discover the Range of mdesign home decor Products